📄🟡 1CC Alpha Report: June 23, 2023

Institutional Money Takes the Orange Pill: Bitcoin Surges at the News of BlackRock’s BTC ETF

🚀 Launchpad: A Week in Review

Here’s a taste of what we’ve got lined up for you this week:

BlackRock files for Bitcoin ETF

Citadel, Fidelity, and Charles Schwab launch crypto exchange

Mastercard files trademark application to develop crypto and blockchain software

WisomTree files for Bitcoin ETF

Deutsche Bank applies for digital asset license with German regulator

ZachXBT gets sued by MachiBigBrother

Bullish sentiment has reached a fever pitch with institutional interest in Bitcoin. BlackRock fired the starting pistol, and where one goes, the rest follow. BlackRock filing for a Bitcoin ETF means unequivocally that BlackRock is long on Bitcoin, and when pensions allocate to Bitcoin, it means the asset becomes entrenched in TradFi. Even Jerome Powell recently commented on crypto’s ‘staying power’ as an asset class.

Institutional money has arrived, the moment investors have waited on for years. However, let us not forget that the SEC launched aggressive lawsuits against Coinbase and Binance then major TradFi entities swooped in. Everyone’s bags pump, but at what cost?

📊 Market Pulse: Influencer Sentiment and Trading Activity

📌CryptoCapo Remains Bearish

https://t.me/CryptoCapoTG/97

Capo may remain bearish, but he is alone in this sentiment, with the majority of large Crypto Twitter figureheads signaling that the BlackRock and subsequent Bitcoin ETFs represent a watershed moment for crypto.

📌Kang targets $100,000+ within three years of BTC ETF Approval

https://twitter.com/Rewkang/status/1671558933847355394

Andrew Kang believes between $50,000 and $70,000 is a fair price for $BTC with ETF approval and above $100,000 within three years of approval.

📌DegenSpartan Outlines the Current Race Between TradFi Entities to Accumulate

https://twitter.com/DegenSpartan/status/1671514982096285703

Good news for everybody already holding crypto. DegenSpartan states how TradFi entities currently accumulate to dump on the TradFi entities that arrive late. He describes early holders and their ability to dump on TradFi as ‘unavoidable collateral damage to operate in this lucrative segment.’

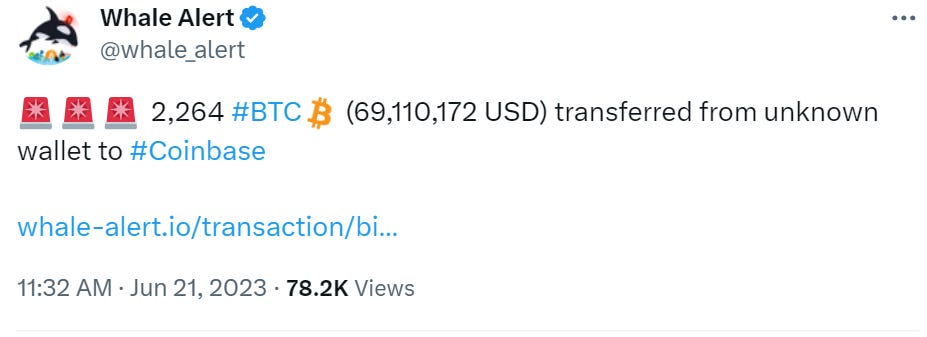

📌Whales on the Move: Several Large Movements to CEX Wallets

https://twitter.com/whale_alert/status/1671576987175985162

Transaction: https://whale-alert.io/transaction/bitcoin/9e58b90bcaeccf17a48fe1e2ec36204b056ebc37af5ac309786d38afa22b6415

https://twitter.com/whale_alert/status/1671556770576187393

Transaction: https://whale-alert.io/transaction/bitcoin/1116996fe92a719eaca38c92205c43447fd8df29fb0470653552cace4566e223

https://twitter.com/whale_alert/status/1671539993620168705

Transaction: https://whale-alert.io/transaction/bitcoin/f0f3c5db98ee761d167113bc7b72f080c2e45e2a009919870a26a9775df9679e

The largest movement went in the opposite direction. Which asset manager is stocking up and self-custodying $BTC? BlackRock? Charles Schwab?

💹 DeFi Dynamics: Yield Changes and New Launches

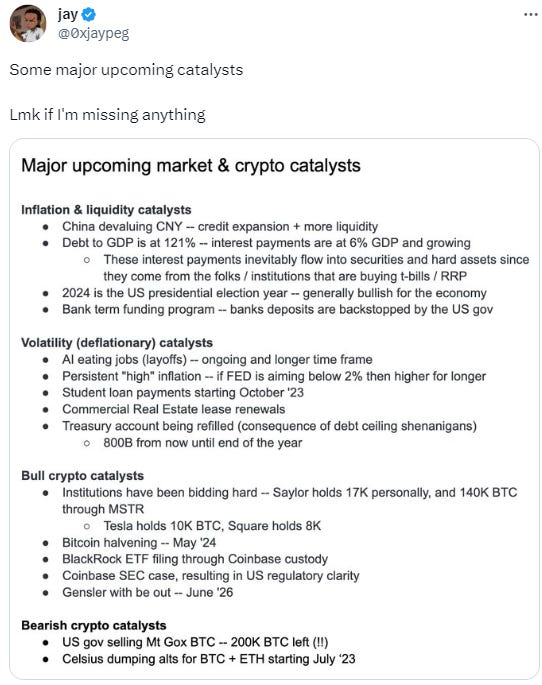

📌 China Expands Liquidity: The Cycle of the Dragon

https://twitter.com/0xjaypeg/status/1670489794105733120

China has reversed credit tightening, signaling that the West should follow suit in the next twelve months. The global crypto developments increasingly point to China repealing its crypto ban and powering the next bull run. Investors should note bullish catalysts massively outweigh bearish catalysts both in significance and quantity: the trend is your friend.

📌 Frax Announces Layer Two Chain: Fraxchain

https://twitter.com/StableScarab/status/1671362353525567488

Frax announced its plan to introduce a hybrid rollup. Fraxchain will bring the entire Frax ecosystem and all its products to a single layer two at a far more attractive cost-basis for users- increasing the value proposition of $FXS.

📌 Binance Releases LSDFi Report

https://research.binance.com/static/pdf/lsdfi-when-liquid-staking-meets-defi.pdf

‘We have barely scratched the surface.’ Confirmed, Binance is bullish on LSDFi.

The report tracks the rampant growth of LSDFi from a liquidity perspective and shows the demand for Ethereum staking. It details that LSDFi protocols currently command ‘‘less than 3% of the total addressable market.’’

For a full breakdown, read the thread below: https://twitter.com/Moomsxxx/status/1670446076682289153

📌 opBNB: Binance Smart Chain Optimistic Rollup

https://www.bnbchain.org/en/blog/introducing-opbnb-unleashing-a-new-era-of-scalability/

Binance has introduced a layer two scaling solution using the OP Stack. This layer two will provide a massive scalability boost and will allow for greater functionality for execution-heavy applications such as gaming. Binance has already begun prepping for the next wave of adoption.

For greater depth, read the thread below:

https://twitter.com/0xFinish/status/1671217959568818178

📌 unshETH Aims to Decentralize LSD Market

unshETh a new LSD introduces ‘‘decentralization through incentivization.’’ unshETH more evenly distributes capital across the LSD ecosystem while prioritizing validator decentralization

The thread below provides a succinct TLDR:

https://twitter.com/CryptoGideon_/status/1667184822836404226

Keep reading with a 7-day free trial

Subscribe to One Click Crypto to keep reading this post and get 7 days of free access to the full post archives.