📄🟡 1CC Alpha Report: June 30, 2023

The Whooshing Continues: The Rest of the World Eats up Web3 While America Falls Behind

🚀 Launchpad: A Week in Review

Here’s a taste of what we’ve got lined up for you this week:

Ark Invests Adds Surveillance Agreement to Bitcoin ETF Application

Saylor Buys $347 Million of $BTC

Mastercard Pilots Tokenized Bank Deposits in the UK

Azuki Flops

Rodeo Public Presale

Time-Based Capitulation Ongoing

TUSD Drama Continues

The depths of the bear market have likely passed, and the PVP nature of crypto intensifies. The trouble with PrimeTrust could spill over into $TUSD, which would affect Binance, given its integration of the stablecoin. The $220 liquidation threat for $BNB still looms. Has Azuki diluted its holders? And SUI gets caught paying people with staking rewards from locked tokens? Never a dull week in crypto.

The race for Bitcoin Spot ETF rages on, and investors' prime purpose in the current stage of the bear market is to preserve their capital whilst accumulating. The markets follow the same trend, one year red, three years green.

📊 Market Pulse: Influencer Sentiment and Trading Activity

📌Time-Based Capitulation Continues

https://twitter.com/Pentosh1/status/1673317485045530624

Pentoshi believes that the worst of the bear market has already passed and that investors should think more about the upside than further downside. What’s a 30% retrace compared to a potential 10X in the next two years?

📌$TUSD Drama Continues

https://twitter.com/CurveCap/status/1674095764694528000

Prime Trust halted redemptions which caused $TUSD to briefly depeg nearly two weeks ago, and it appears that the stablecoin has more skeletons in its closet. Allegations have even surfaced of Prime Trust losing access to customer wallets in 2021.

Attached below are a timeline of the events and a thread breakdown:

https://twitter.com/HodlMagoo/status/1673757606475603987

https://twitter.com/adamscochran/status/1673832056944558080

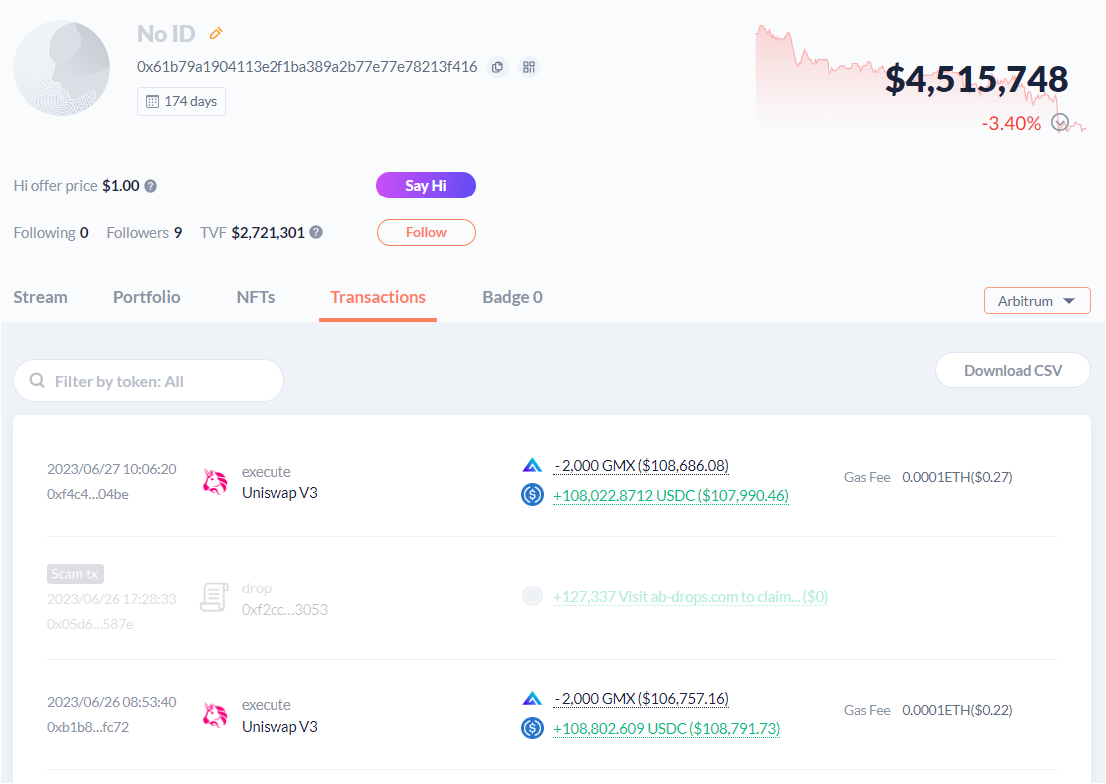

📌Large $GMX Holder Begins to Scale Out of Position

https://debank.com/profile/0x61b79a1904113e2f1ba389a2b77e77e78213f416/history?chain=arb

The reason for these large sell orders remains unknown, but conjecture points to a sell-off in the run-up to GMX V2 or perhaps a rotation into another leveraged perp DEX? Level Finance has slowly become the darling of on-chain perp investors.

📌Chibi Finance Rugs $1 Million of Investor Funds

https://twitter.com/TheBlock__/status/1673754907667472387

555 ETH was drained from the protocol’s liquidity pools and routed through Tornado Cash, and the team’s digital presence disappeared- not a great sign. The native token $CHIBI understandably nosedived into oblivion.

📌Algod Compares Crypto to DotCom Bubble

https://twitter.com/AlgodTrading/status/1673820370539872258

Taking profits can be difficult, especially given crypto investors' propensity for risk and the Lambo or broke culture that permeates the space. Reading between the lines this tweet says stack $ETH, have sell targets, and stick to them.

📌 SUI Gets Caught

https://twitter.com/DefiSquared/status/1673572324145078273

DeFi Squared released a great thread with a detailed on-chain dive into SUI, which revealed the project has been selling rewards from locked/ non-vested tokens. This research will prove fruitful for investors curious about the constant sell pressure on $SUI.

💹 DeFi Dynamics: Yield Changes and New Launches

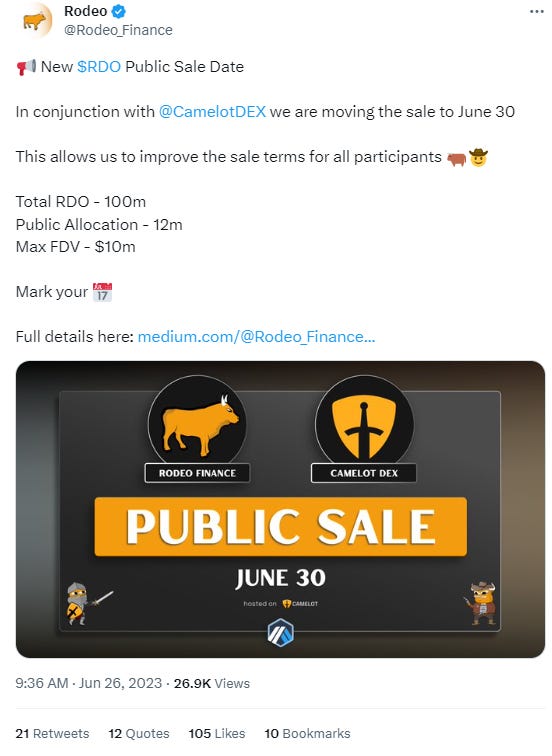

📌Rodeo Finance Public Sale June 30th Camelot DEX

https://twitter.com/Rodeo_Finance/status/1673339389013901312

Rodeo Finance, a leveraged yield farming protocol that has rapidly been occurring liquidity on Arbitrum, launches its token $RDO to the public.

📌USDC Goes Native on Arbitrum, and Circle’s CCTP Goes Live

https://twitter.com/circle/status/1673678076746637318

Circle’s CTTP (Cross-Chain Transfer Protocol) allows native transfers between Ethereum, Avalanche, and now Arbitrum. The feature uses a burn and mint functionality, similar to the OFT token standard, which means the total supply stays fixed across locations, but the chain locality is fully elastic. Does this mean greater stablecoin inflows to Arbitrum?

📌Vela Returns

https://twitter.com/vela_exchange/status/1674131387845332992

Vela has launched public access returning to Arbiturm. Currently, users can mint hyperVLP with USDC with an excellent yield boost. The new version of Vela comes with more assets, and airdrop claims are now live.

📌Hype Surrounding Artichoke Continues to Grow

https://twitter.com/NathanDegen_/status/1673644225563598848

The protocol allows users to provide single-sided liquidity for LP positions reducing the risk of impermanent loss through the use of its synthetic liquidity token tCHOKE.

Keep reading with a 7-day free trial

Subscribe to One Click Crypto to keep reading this post and get 7 days of free access to the full post archives.