Rainforest Stack #005: Best DeFi Yields (Dec 15, 2023)

Late longs got punished on December 11th. A liquidation flush saw over-leveraged traders get wiped out, and as more institutional players wade into crypto markets, profitable liquidation zones will be targeted. This is likely the last month of trading action pre-Spot ETF.

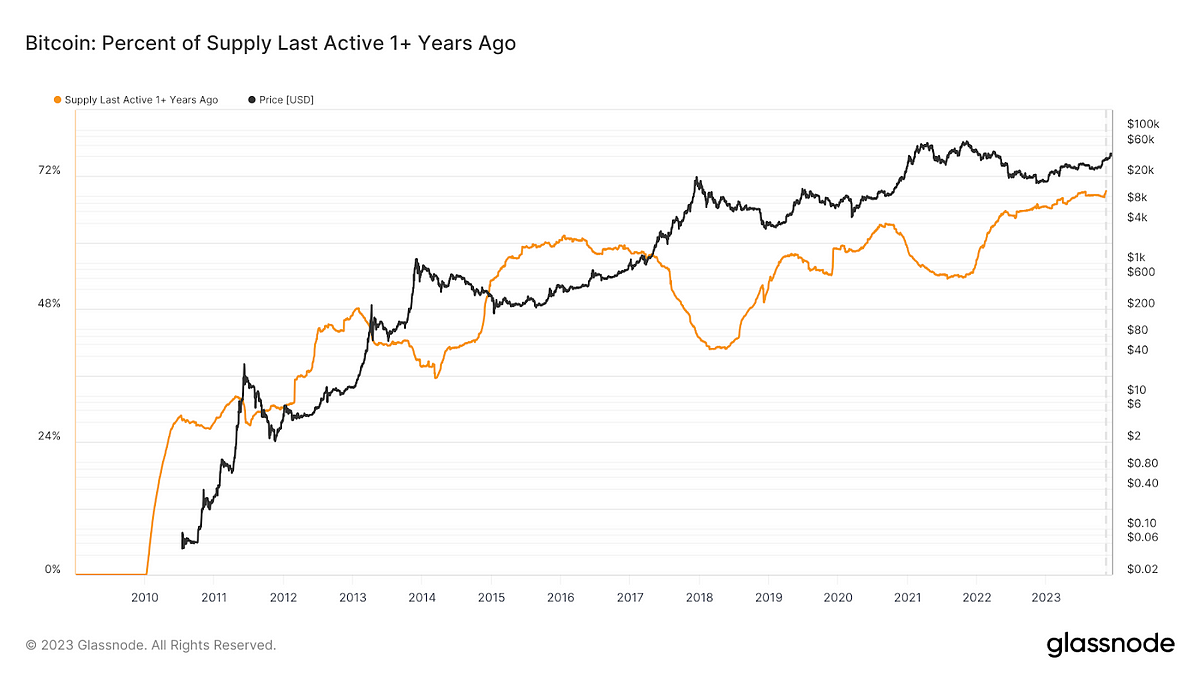

Nearly 70% of Bitcoin has not moved in the last year. Holders continue diamond handing, and leverage washouts do not affect spot buyers and holders. After two months of practically vertical price movement, a correction is natural, and the larger question is, will markets nuke in January? A popular theory floated on Crypto Twitter by prominent trades such as Rhino.

Regardless of $BTC action, many altcoins have recovered quickly from the downturn, and these will likely go on to become overperformers in the next cycle: $INJ, $AVAX, $TIA, $OP, $SNX, $SOL, $LINK, $RUNE.

Plenty of money is still locked in DeFi, and investors are riding out the dip and continuing to farm.

Welcome to the Rainforest Stack. A guide for the intrepid into the dynamic world of DeFi yield.

Constituted of four distinct layers: undergrowth, understory, canopy, and the emergent layer. Each layer boasts a different level of risk broadly categorized in line with the Lindy effect- the longer something has survived, the more likely its continued existence becomes.

An impact with oversized ramifications in the crypto space where hundreds of new protocols live and die each quarter.

More details about the Layers of the Rainforest stack are here.

Emergent Layer — Enduring Yields

Pool: stETH on Lido. APY: 3.8%. TVL: $19.9b. Chain: Ethereum

Pool: DAI on Maker (DSR). APY: 5%. TVL: $1.59b. Chain: Ethereum

Pool: rETH on Rocket Pool. APY: 3.65%. TVL: $2.26b. Chain: Ethereum

Pool: frxETH on Frax. APY: 4.01%. TVL: $658m. Chain: Ethereum

Pool: GMX on GMX V1. APY: 4.62%. TVL: $296m. Chain: Arbitrum

Keep reading with a 7-day free trial

Subscribe to One Click Crypto to keep reading this post and get 7 days of free access to the full post archives.