Rainforest Stack #006: Best DeFi Yields (Dec 21, 2023)

Discover the latest in DeFi yields with Rainforest Stack. Uncover various strategies and opportunities in yield farming, presented in an easy-to-understand format for DeFi rookies and experienced farm

Memecoins are ripping, Bitcoin continues to push up, and Chinese grandmas are sending BRC-20 coins skyrocketing. Are we reaching a local top, or is this just the beginning of the bull market mania?

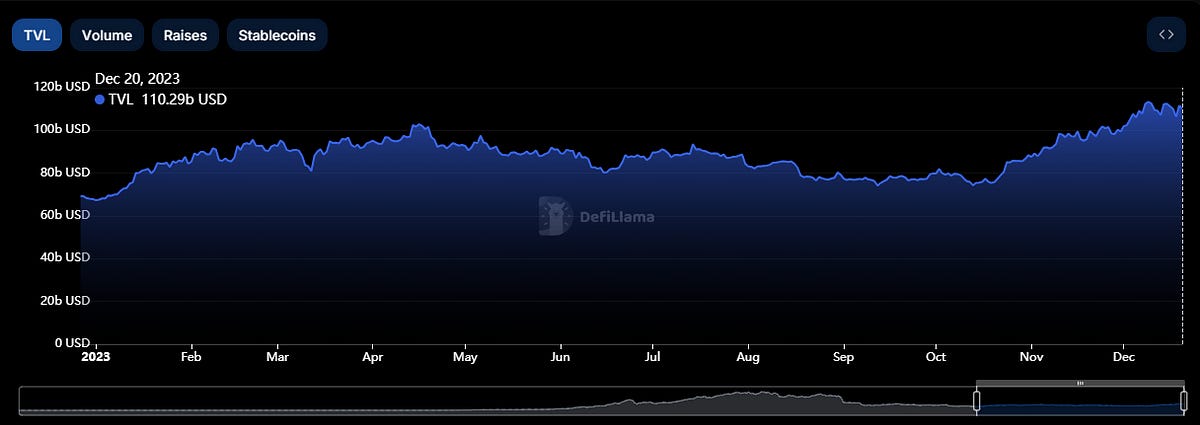

Is a marketwide nuke waiting in the wings, ready to catch everybody naked? There is no way to tell, but DeFi TVL is on the rise, a typically bullish signal. Crypto users are locking their liquidity in protocols, which signals two things: one, they are not looking to sell soon; two, there are sufficiently lucrative opportunities.

TVL started the year at $67.3 billion and has risen over 62% to $109.1 billion. The strong basket of altcoins continues to outperform, and farming conditions have not been this sweet since 2021.

Welcome to the Rainforest Stack. A guide for the intrepid into the dynamic world of DeFi yield.

Constituted of four distinct layers: undergrowth, understory, canopy, and the emergent layer. Each layer boasts a different level of risk broadly categorized in line with the Lindy effect- the longer something has survived, the more likely its continued existence becomes.

An impact with oversized ramifications in the crypto space where hundreds of new protocols live and die each quarter.

More details about the Layers of the Rainforest stack here.

Emergent Layer – Enduring Yields

Pool: stETH on Lido. APY: 3.8%. TVL: $19.9b. Chain: Ethereum

Pool: DAI on Maker (DSR). APY: 5%. TVL: $1.52b. Chain: Ethereum

Pool: rETH on Rocket Pool. APY: 3.32%. TVL: $2.33b. Chain: Ethereum

Pool: frxETH on Frax. APY: 3.86%. TVL: $669m. Chain: Ethereum

Pool: GMX on GMX V1. APY: 3.09%. TVL: $279m. Chain: Arbitrum

Keep reading with a 7-day free trial

Subscribe to One Click Crypto to keep reading this post and get 7 days of free access to the full post archives.