Rainforest Stack #010 Best DeFi Yields (Jan 18, 2024)

Discover the latest in DeFi yields with Rainforest Stack. Uncover various strategies and opportunities in yield farming, presented in an easy-to-understand format for DeFi rookies and experienced farm

Bitcoin has bumped its head, and Ethereum continues leading the market, giving altcoins real room to run. The biggest behind-the-scenes event currently ongoing is the SEC vs Coinbase case taking place in New York. A win for Coinbase would be massive for the industry and a huge blow to Genlser’s regulation-by-enforcement approach. Brian is fighting the good fight, and Fink is shilling asset tokenization as the next evolution of markets. Great time to be holding Spot bags.

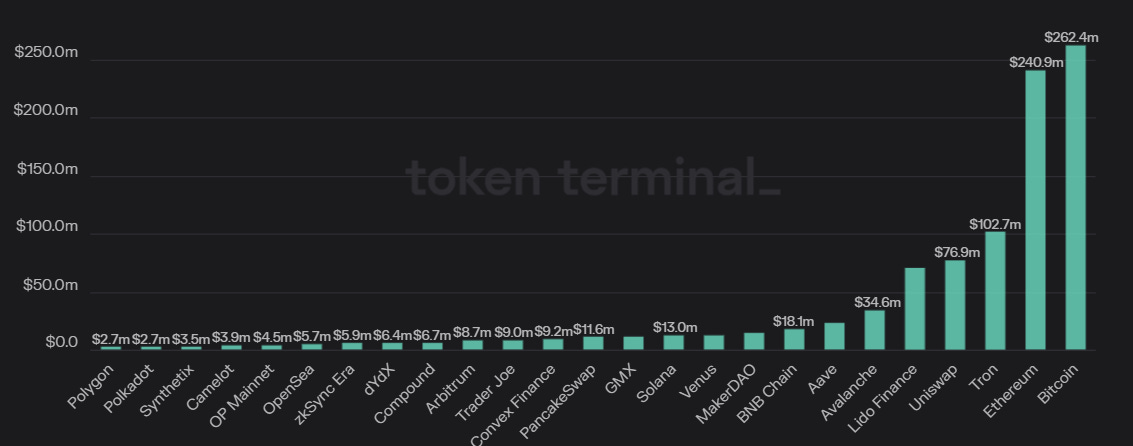

Nothing is sacred in crypto, and investors must learn how to pivot- imagine if in 2021 somebody said that NFT volume on Bitcoin would outpace NFT volume on Ethereum. Bitcoin’s monthly fees have eclipsed Ethereum’s due to the BRC-20 craze. Ordinals are the first step in a broader innovation wave that will help solve Bitcoin’s long-term security problem. The question has always been how Bitcoin will pay miners as issuance drops over time. Are Ordinals and DeFi built on top of the Bitcoin network the answer?

Lido continues crushing it, and expect to see EigenLayer/ another restaking protocol creeping into the top fee generators in the coming months. Solana remains impressive as ever, and the bulk of on-chain activity comes from DEXs/ perps, showing investors have an appetite for speculation. DeFi TVL looks healthy, and the wealth creation from $ETH’s appreciation is breathing new life into on-chain activity on layer twos.

Welcome to the Rainforest Stack. A guide for the intrepid into the dynamic world of DeFi yield.

Constituted of four distinct layers: undergrowth, understory, canopy, and the emergent layer. Each layer boasts a different level of risk broadly categorized in line with the Lindy effect- the longer something has survived, the more likely its continued existence becomes.

An impact with oversized ramifications in the crypto space where hundreds of new protocols live and die each quarter.

More details about the Layers of the Rainforest stack here.

Emergent Layer — Enduring Yields

Pool: stETH on Lido. APY: 3.5%. TVL: $23.53b. Chain: Ethereum

Pool: DAI on Maker (DSR). APY: 5%. TVL: $1.43b. Chain: Ethereum

Pool: rETH on Rocket Pool. APY: 3.12%. TVL: $2.82b. Chain: Ethereum

Pool: frxETH on Frax. APY: 4.21%. TVL: $790m. Chain: Ethereum

Pool: GMX on GMX V1. APY: 3.79%. TVL: $329m. Chain: Arbitrum

Keep reading with a 7-day free trial

Subscribe to One Click Crypto to keep reading this post and get 7 days of free access to the full post archives.